The African Export-Import Bank (Afreximbank) ( www.Afreximbank.com ) has approved a US$20.8 million financing facility for Nigerian company Starlink Global&Ideal Limited to build and operate a 30,000 metric tonnes per annum cashew processing plant in Lagos.

Under the terms of the facility agreement signed on 22 July 2024, Afreximbank will provide the funds in two tranches, with the first tranche of US$7.48 million being earmarked for capital expenditure for the construction of the plant and the second tranche, totalling US$13.25 million, being deployed as working capital for the operation of the plant.

The facility is expected to promote value addition that will ensure an increase in the company’s revenues while promoting the creation of about 400 new jobs once the plant is operational. It is also expected to support about forty small and medium-sized enterprises.

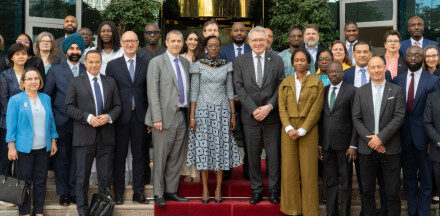

Commenting on the transaction, Ms. Kanayo Awani, Afreximbank’s Executive Vice President, Intra-African Trade and Export Development, said that by supporting Starlink Global in setting up a modern processing plant, Afreximbank is enabling Africa to add value to its agri-food products, thereby facilitating exports and the subsequent inflow of much-needed foreign exchange to the continent.

“We are delighted with this partnership which is expected to generate significant employment impact in Nigeria. It will contribute to value creation and local community development while improving the lives of smallholder farmers and small business suppliers who will work with Starlink throughout the value chain,” added Ms. Awani.

Distributed by APO Group on behalf of Afreximbank.

Follow us on:

X: https://apo-opa.co/3NbYxVn

Facebook: https://apo-opa.co/3N99siJ

LinkedIn: https://apo-opa.co/3Yah4HW

Instagram: https://apo-opa.co/3NiNxp3

About Afreximbank:

The African Export-Import Bank (Afreximbank) is a pan-African multilateral financial institution dedicated to financing and promoting intra- and extra-African trade. For 30 years, Afreximbank has been deploying innovative structures to provide financing solutions that facilitate the transformation of African trade patterns and accelerate industrialization and intra-regional trade, thereby supporting economic expansion in Africa. A strong supporter of the African Continental Free Trade Area (AfCFTA) Agreement, Afreximbank launched the Pan-African Payment and Settlement System (PAPSS) which was adopted by the African Union (AU) as the payment and settlement platform to support the implementation of the AfCFTA. In collaboration with the AfCFTA Secretariat and the AU, the Bank has established a US$10 billion Adjustment Fund to support countries to participate effectively in the AfCFTA. As at end-December 2023, the Bank’s total assets and guarantees stood at approximately US$37.3 billion and its shareholders’ funds stood at US$6.1 billion. Afreximbank is rated A by GCR International Scale, Baa1 by Moody’s, A- by Japan Credit Rating Agency (JCR) and BBB by Fitch. Over the years, Afreximbank has evolved into a group comprising the Bank, its impact finance subsidiary called Export Development Fund for Africa (FEDA), and its insurance management subsidiary, AfrexInsure, (the three entities together form “the Group”). The Bank is headquartered in Cairo, Egypt.

For further information please visit: www.Afreximbank.com